As the year draws to a close, we want to provide information regarding your property taxes in Idaho. Especially regarding financial responsibilities, we want to ensure you have the necessary details for the timely and accurate payment of your taxes. It’s essential to be aware that the first half of your taxes are due on December 20, and the second half is due on June 20.

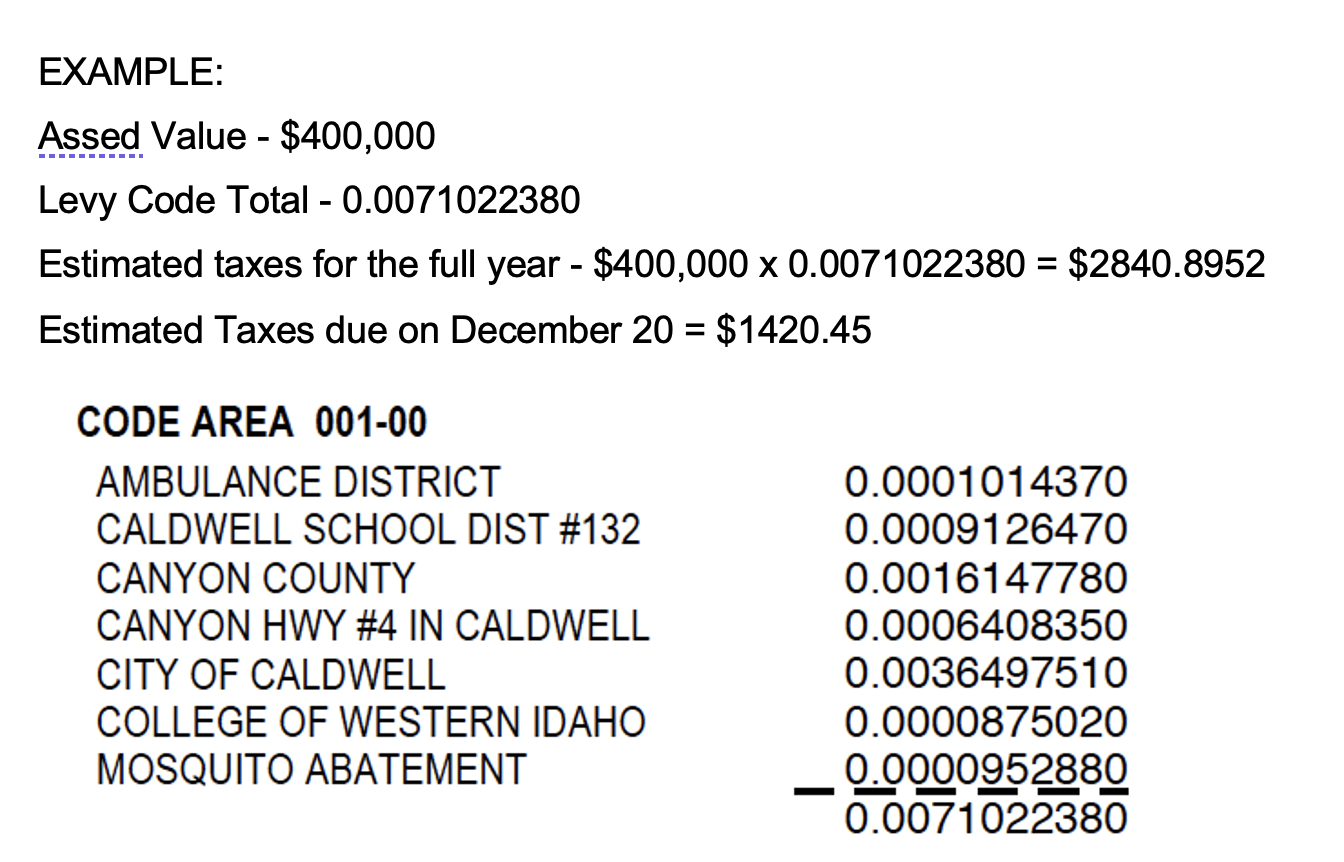

In Idaho, property taxes are typically calculated by multiplying the assessed value of your property by the levy code total for your specific levy code area. The county assessor determines the estimated value based on factors including property size, improvements, and market conditions, while the levy code total represents the tax rate for your area. By multiplying these values, property owners can estimate their annual taxes. It’s important to note that certain exemptions may apply to some properties, impacting the final amount due.

In the example above, the levy code area’s percentage is multiplied by the assessed value to determine your current year’s tax. The tax levy can be comprised of ambulanace services, school districts/levies, and local jurisdications/public services.

In most cases, property taxes are paid from your escrow account, but if you have any questions, don’t hesitate to contact your escrow officer for assistance.

In positive news for Ada County homeowners, the Idaho State Legislature has recently enacted a property tax bill that brings relief, with homeowners set to receive $99 million. As we usher in 2024, Ada County homeowners can look forward to entering the new year with decreasing property taxes. For inquiries regarding your property tax statement, exemptions, or payment options, your local county tax office is well-equipped to assist you in navigating the process and addressing any concerns you may have.

To learn more, check out the video below, produced by the Idaho Association of Counties. It provides valuable information and a step-by-step guide on property taxation in the State of Idaho.