Your property value in Idaho may change every year, which in turn can change the amount you pay in property taxes. Each year, the county assessor develops guidelines based on market analysis, which impacts tax payments. Dependent on market changes, your taxes may rise or fall.

For most taxpayers, your tax bill will arrive by the fourth Monday of November. Your tax bill can be paid to the county treasurer in two equal installments; the first half on or before December 20th, and the second half on or before June 20th. If you have any questions or concerns about this, you’ll want to contact your county treasurer.

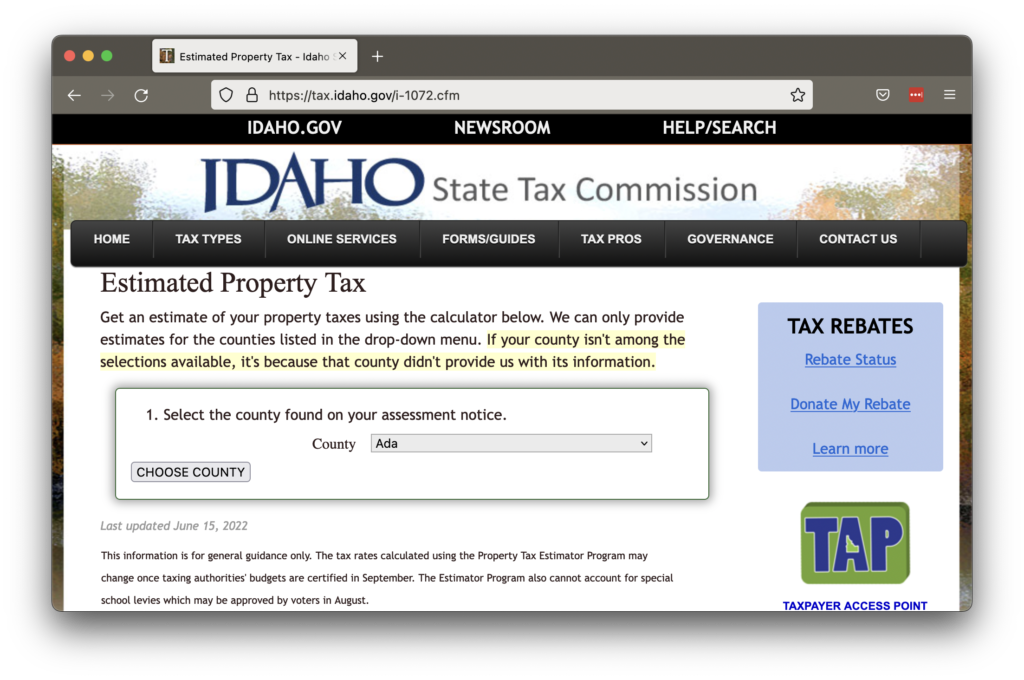

tax.idaho.gov offers homeowners a handy property tax estimator. The tax rates calculated using the Property Tax Estimator Program may change once taxing authorities’ budgets are certified in September. The Estimator Program also cannot account for special school levies which may be approved by voters in August.

While most taxing districts have a maximum tax rate they can charge, the amount of tax is determined by the budget needs of each district. Districts not including schools are limited to a 3 percent increase plus a growth allowance in their budget. These funds may go to services, schools, or highways, among other things. To find out which districts your property is in, please refer to your assessment notice which will usually arrive by the first Monday in June. While not a bill, this document contains important information about your property such as assessed property value and districts that are funded by your property taxes.

While property taxes are most likely paid through the escrow account on your property, your title company does not determine how much you will pay. For any questions, please contact your taxing districts, county treasurer, or county assessor.